Calgary Market Report

JULY 2021

JULY 2021

If you’re thinking about selling your home, it's important to have a good understanding of what’s going on in the Calgary market.

Knowing the most important data such as the average sales price, number of homes sold, and days on market will better prepare you to sell your home.

Our market report showcases everything you need to know about local real estate trends.

Price growth slows as supply to demand balance improves

City of Calgary, August 3, 2021 –

July sales totalled 2,319 units, which is well above long-term averages and the best July on record. The pace of sales growth has eased over the past few months, but so too has the pace of new listings growth. This has helped prevent any further monthly gains in inventory levels, and while overall supply remains slightly higher than last July, it’s mostly due to gains in apartment and row product.

With 6,678 units in inventory in July, the months of supply rose to just under three months. These gains are leading to far more balance between sellers and buyers. However, there is a significant variation between product type, as the months of supply ranged from two months in the detached sector to nearly six months in the apartment condominium sector.

“Over the past several months, we have seen housing market conditions trend toward more balanced conditions,” said CREB® Chief Economist Ann-Marie Lurie. “This eased some of the upward pressure on prices, as prices are starting to stabilize following steep gains that occurred in the first half of the year.”

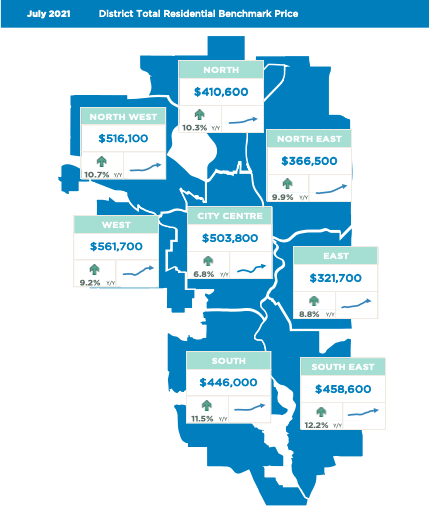

Benchmark prices in the city reached $460,100, slightly higher than last month and nearly 10 per cent higher than last July. Price growth has been the highest in the detached sector, which currently sits 11 per cent above last year’s price and has finally recovered from previous highs in 2014.

HOUSING MARKET FACTS

Detached

Both sales and new listings trended lower relative to last month, but remained higher than last year’s levels. Sales are still at record levels, but with only 1,822 new listings coming onto the market in July, the sales-to-new-listings ratio remained relatively high at 78 per cent.

Slower sales relative to the inventory levels also caused the months of supply to trend up. With just over two months of supply conditions remain relatively tight. However, this is an improvement relative to the past five months. Activity also varies by price range, with homes priced below $500,000 still facing tight market conditions with less than two months of supply.

Prices continued to trend up this month over last month. At a city-wide benchmark price of $539,900, prices are 11 per cent higher then last year’s levels. Prices have been on the rise in every district, but it is only the City Centre that is reporting prices below the 2014 high.

Semi-Detached

While sales activity did slow in some districts compared to last year, overall year-to-date levels remain at historic highs. While new listings are higher than last year’s levels, they trended down enough compared to last month to cause a slight monthly decline in inventory levels. With 209 sales and 577 units in inventory, the months of supply rose to nearly three months. This is still lower than levels recorded last year, but much higher than the extremely tight conditions recorded over the first half of the year.

Benchmark prices continue to rise over last month, but like other property types, at a slower pace. Nonetheless, at a benchmark price of $428,400 in July, levels are nearly ten per cent higher than last year and have recovered from previous highs. While price gains have occurred across most districts, on a year-to-date basis, they have not yet fully recovered from previous highs in the City Centre, North East, South and East districts.

Row

Following 351 sales this month, year-to-date sales are sitting at record highs. While the pace of sales growth is slowing relative to earlier in the year, so too is the pace of new listings coming onto the market, prevented any further monthly inventory gains.

With inventory levels over 1,000 units and slightly slower sales this month compared to last, the months of supply pushed up above three months. While levels are lower than anything recorded last year, the improved choice is slowing the monthly price gain. However, prices remain nearly 11 per cent higher than last July.

Compared to last year, prices have improved across every district, with gains ranging from a low six per cent in the northwest to a high of 20 per cent in the east district. Despite the gains, prices continue to remain well below previous highs.

Apartment Condominium

Thanks to reductions in new listings, inventory levels trended down over the previous month yet remain relatively high with 1,918 units available. While trending down relative to last month, July sales are still far better than any July over the past six years. However, the higher inventories relative to sales did contribute to the monthly rise in the months of supply, which sits just below six months.

Additional supply choice is having some impact on prices depending on the district. While prices have stalled or eased slightly in most districts compared to last month, strong gains still occurred in the south and southeast districts. While prices remain higher than levels recorded last July, they remain far from price recovery.

(Source: CREB®)

New Listings

Inventory

Total Sales

Average Sales Price

Average Days on Market

Months of Supply

Sale-to-List Price